The Internet has come a long way since its humble beginnings in the late 1990s. Nearly any kind of transaction can occur online with the proper payment type. There’s no need to mail in a payment when it can be instantly pulled from your account with the product shipped to your address in a heartbeat. Explore the various payment processes used in today’s online marketplace so that your next transaction can be as smooth as possible.

Electronic Fund Transfer

A tried-but-true process to pay for your online items is by electronic transfer. You type in your checking-account information, including the routing and account number, so that the funds are simply swapped between financial institutions. If you don’t have a credit or debit card, this transaction is a safe and simple way to keep up with the modern age. Websites use a lot of security software in order to keep your information safe from any unwanted attention.

The one downside to this payment method is that it usually takes three to five business days to clear, depending on the applicable rules from the financial institutions involved. However, most financial institutions and merchants compensate for that small inconvenience by waiving any “convenience” fees.

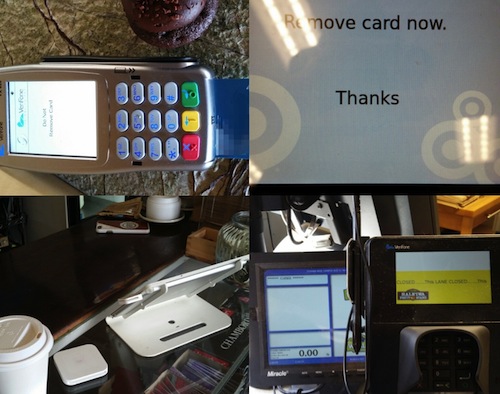

Credit Card

The majority of consumers have credit cards because they’re used to spread costs over a month or longer. They also have safeguards in case of fraudulent charges. In essence, the consumer doesn’t have to pay for an item that wasn’t authorized by the holder. Regardless of its size, any merchant accepting credit card payments must abide to the appropriate Payment Card Industry Data Security Standard (PCI DSS) to prevent fines from credit card companies in case of a data breach.

For these reasons, you can use credit cards online for most purchases. You have the option of saving the information on the website’s server too. This option makes your next purchase easier because typing in the information isn’t necessary. Merchants storing your credit card data must also follow PCI DSS guidelines to protect it against malicious hackers.

Debit Card

Your bank usually issues a debit card along with your checks so that you can charge items to your checking account. Use this card in the same manner as the credit card, and the funds are simply taken out of your checking account the same day.

You’ll still need to type in the number and expiration date so that the transaction can move forward. In most cases, you won’t want to save the account number on the website’s server. Because it’s directly linked to your checking account, any misappropriation of the card number might compromise your funds.

One disadvantage of using a debit card for payments is that some financial institutions may put a hold on your funds larger than the payment that you’re trying to complete. You may have run into this situation when renting a car or filling up gas. These rules vary per financial institution so contact yours to learn what rules apply to your debit card.

Electronic Alternative

Many consumers are turning to third parties to charge their online goods. PayPal, Venmo, and other companies create a middleman for transactions. These companies secure your debit or credit-card information as you charge a purchase to your third-party account. All of the transactions are protected by extra software as a result.

To boost time spent on apps, some social networks have jumped on board to allow their users to exchange payments. Snapcash allows first-time users of its Snapcash service to send up to $250 per week and receive up to $1,000 per month. Not to be left behind, Facebook allows its users to send and receive even higher amounts from the start through Facebook Messenger.

Both Snapcash and Facebook charge no fees to process payments funded with debit cards.

Smartphone or Watch

One of the newest ways to buy online items is through your smartphone or advanced watch. Program your payment information (generally a checking account or credit card) into your device, and you can quickly check out without typing in a long number. Online purchases have never been easier to buy.

Some credit card companies are going the extra mile to add extra security when linking your credit card to your smartphone. For example, Mastercard is rolling out a “selfie payment” option in which you take a selfie, instead of typing a password or entering a CVV, to verify your identity. The Mastercard selfie payment software requires users to blink before they take the picture to prevent people from just holding up a picture. So, the next time that you see somebody winking at their phones a couple of times, you know that they might be buying something online!

The Bottom Line

Virtual retailers are always updating their online shopping cart software so that your experience has no hiccups. As you work through a transaction, be sure that the website has an “https” before the URL. This designation means that the transaction is secure. Avoiding online theft is a daily battle, but most consumers will have no problems as they pick and choose favorite items to buy.

Anyone who a operates a business knows that taking credit cards is important. Not everyone carries a lot of cash around with them, and there are risks with taking checks that might not clear the bank. Credit

Anyone who a operates a business knows that taking credit cards is important. Not everyone carries a lot of cash around with them, and there are risks with taking checks that might not clear the bank. Credit