- E-mail Permission Marketing: It Works!

- E-mail Permission Marketing Fundamentals

- How to Measure the CTR of Your E-Mail Permission Marketing Campaign with Google Analytics

A Guide to Permission Marketing

–

–

Ideas and Concepts from Damian Davila

Welcome back, today we are analyzing the Internet Business Model from the leader in web attitudinal web analytics, the Canadian firm iPerceptions.

Here at idaconcpts, I have mentioned how their 4Q service can make the Internet a less scary place.

In this post I’m going to analyze iPerceptions Business Model.

iPerceptions (TSX: IPE) is a provider of web-focused Voice of Customer analytics. Founded in 2000, iPerceptions focuses on a goal of “improving and optimizing websites by tapping into the feedback of real customers in the context of actual online experiences.” Its mission is to revolutionize web analytics by fully democratizing the voice of the online customer. The vision of the company is to have customers speak for themselves and to ensure that they are heard at the highest decision making levels. iPerceptions focuses not on “what” customers do on the web, but “why” they do things on the web. It helps its customers understand who is going to their websites, the reasons for going, and how satisfied they are with completing their goals. The company provides innovative ways of tracking customer behavior and translating that information into usable strategic support that can companies can use to optimize their Internet channel.

Many knowledgeable and well-known technological leaders that bring experience and innovation to the company form iPerceptions’ management team and advisory board. These people include Jerry Tarasofsky (President, CEO), Stephen Berns (CIO), Jonathan Levitt (VP, Marketing), and Avinash Kaushik (author of Occam’s Razor). Its client list spans many different industries including hotels, automobile manufacturers, electronics, IT companies, and includes many large companies such as Dell, Toshiba, Reebok, BMW, and Yamaha.

While the company has yet to be profitable, its client list and management team are impressive attributes to this young company. The company has sound performance goals and prominent clients that rely on their services.

Next, here is an analysis of its e-commerce industry:

iPerceptions is an on-demand provider of web attitudinal, web analytics services and research for online marketers and Fortune 500 companies. iPerceptions’ solutions impact two traditional business intelligence practices:

1. Website Analytics and

2. Market and Customer Satisfaction Research.

Because iPerceptions’ solutions overlap with many companies in different areas, it is hard to differentiate iPerceptions’ services from others. Each competitor in the web analytics field seeks to differentiate from others by offering a unique approach. Therefore, given the infancy of this industry, there are no true substitutes, but rather, competitors with different approaches.

Competitors (an abbreviated list):

Is iPerceptions’ business, a profitable one?

iPerceptions’ revenue margin has consistently been about 50% of sales for the last few years. Its operating expenses however are very high, exceeding its annual revenue. These high operating expenses are mainly due to sales and marketing, administrative costs, and research and development. These types of expenses are often elevated in a young, growing company that is actively trying to improve its product and gain market share.

iPerceptions current model is to charge a single fee for full service. However, in order to continue utilizing a large operating budget it is important to acquire alternative sources of revenue. Some potential possibilities could be:

Conclusions and recommendations:

With the entry of Google Analytics, the web analytics market has simply exploded, because now anyone who wants to have access to data from their website can have it for free. Yahoo’s and Microsoft’s anticipated free web analytics tools will only expand the options that practitioners have at their disposal. But access to the tool and data, although empowering, does little to ease the problems related to figuring out what a company’s success metrics are and how to perform web analytics correctly. This is mainly why web analytics solution providers such as iPerceptions still stay in business.

The main obstacle of iPerceptions is the need for a more sustainable business model. While the major expenses in R&D and sales and marketing are necessary to keep up the first-mover image of iPerceptions, these expenses are not sustainable in the long run, unless alternative, and more importantly fixed sources of revenue are created. Therefore, it is recommended that iPerceptions research the following alternative channels of revenue:

1. Partnerships with hosting companies: Hosting companies such as GoDaddy compete fiercely against their competitors to differentiate themselves as the better provider of hosting solutions. Differentiation is achieved through the offering of a variety of pre-installed plug-ins that range from blogging tools (e.g. WordPress) to mail management tools (e.g. MailChimp) to e-commerce tools (e.g. Google Checkout). iPerceptions could make a similar offering with its 4Q online customer satisfaction tool.

2. Consulting magazine: iPerceptions already holds a wide array of information about web analytics. The company could use some of this information to create an online (or offline) magazine that offers some content for free to create a base of readers. If the reader following of iPerceptions becomes large enough, then the company could sell advertisement space to potential advertisers or marketers. Another alternative is that iPerceptions could charge a monthly or annual fee to readers that would like access to premium content without any advertisement.

3. Industry reports: iPerceptions could release industry reports and sell them online. The cost of creating an online store for web analytics reports is quite low, however iPerceptions would have to analyze whether making reports available online for a fee does not give away too much information about its iPerceptions Satisfaction Index (iPSI).

4. Online workshops: iPerceptions could experiment with live web-seminars to corporate clients as a way to expose clients to the array of services it provides. By providing a live web-seminar to key personnel inside organizations, iPerceptions could tip the balance in the decision of whether or not the potential client should hire the services of iPerceptions. The low-cost of a live web-seminar could provide an inexpensive way for the key decision maker to make a more informed decision about hiring iPerceptions, while providing extra revenue at the same time.

Adding extra sources of income in the internet business model of iPerceptions has a positive impact on the scope, that is the market segments to which iPerceptions offers customer value and the range of products that contain value. The customer value component improves because iPerceptions will be able demonstrate that its customer value is distinct from that of its competitors. Given the infancy of the web analytics field, this is a challenge for all competitors, new and old. Another important observation is that the revenue source component improves in the new Internet business model because the described alternative sources of income should have higher profit margins because of their scalability. The price component is indicated as a positive change because the company would improve its value for the customer’s dollar on the consulting side of business by implementing the alternative sources of revenue. In the final analysis, we believe that there will be important improvements in the relationship between iPerceptions’ revenues and the underlying costs of generating the revenues (cost structure component). This is the main objective of the proposed Internet business model, to expand the customer audience of iPerceptions, in order to divide the fixed costs (R&D and marketing) over a larger base of customers and revenue. iPerceptions needs to take advantage of the low marginal cost of adding an extra customer. Perhaps it wouldn’t hurt that R&D and marketing expenses become more efficient and accountable so that is that there is a better understanding of how they contribute to generating revenue. iPerceptions has the right management and board of advisors to implement this business model, however it needs to act fast to be able to survive to current recession of 2009 as companies are downsizing in their expenditure of consulting services.

Here’s a slideshow that summarizes the presented Internet Business Model Analyisis of iPercetpions:

Today I’m taking a look at the Harvard Business Case #9-501-055 Cofidis.

Undergraduate and Graduate Business students: be sure to quote me! : )

According to the Harvard Business Publishing, these are the learning objectives of this case:

This case allows students to attempt to answer a myriad of questions. How do you treat a financial product from a marketing standpoint? What does marketing add to the generic consumer credit product? What are the determinants of consumer adoption for a new product? How do you combine product and communication strategies? What is the effect of sports sponsoring? How do you build a brand? How should your marketing strategy unfold over time and across borders to build and maintain a strong brand? Is marketing an acceptable activity or an attempt to fool people with products that they misinterpret? What is the role of freedom and control in a value proposition? How do all these soft marketing elements interact concretely to lead to a profit formula?

Here’s how I tackled this case.

Purpose

The main issues that the company faces are: 1) What would the ideal features be for the national commercial websites? 2) How could they make sure that they enhanced the Cofidis money making formula? 3) What should the concept of the Cofidis.com website be? Should Cofidis become the online broker or should there be a new online concept brand? In the other hand, the company must make these decisions while considering the macroeconomic factors, the rates of recovery of outstanding loans, and cultural factors of each country it targets.

Recommended Solution or Course of Action

Cofidis should go ahead with its Internet expansion because it provides a suitable channel to strengthen its deal-making mechanisms. A core competence from Cofidis is non-intrusiveness and the web provides a good place to further implement this policy, combined with greater disclosure of details about payment options. However, I don’t think that Cofidis should risk creating a new website concept but rather reinforce the Cofidis brand.

Analysis

Being an online broker could work against them because they are providing increased market exposure to other competitors. There is no clear future on how the Internet ingredient will drive up profits (particularly because there is no certainty how it will affect handling doubtful accounts); therefore, the company should not make such a big investment of reinventing the brand online but only strengthen it. I agree with Cofidis customizing each country website to the cultures of each nation. It is particularly important that Cofidis pushes its brand by better positioning itself among popular European web search engines. Cofidis ought to consider making strategic alliances with websites that cater the local preferences (e.g. bicycling websites in France). It was interesting to see a lack of discussion of Web 2.0 type promotion.

Welcome back!

Starting today, I’m going to complement my regular posts on online marketing and web analytics with review of current, relevant marketing topics.

Today, I took a look at:

Prahalad, C. K. and V. Ramaswamy (2003). “The New Frontier of Experience Innovation.” MIT Sloan Management Review 44(4): 12

Purpose of this Article

The purpose is that the manager focuses on value creation through innovation. The authors do not offer best practices but new practices in creating an experience environment. They challenge the assumption that just developing core competencies guarantees success.

The Central Message of the Reading?

Prahalad and Ramaswamy (2003) point out idea convergence and co-creation as necessary activities in value creation, which “is defined by the experience of a specific consumer, at a specific point in time and location, in the context of a specific event” (p.14). This proposal challenges the current assumption that value creation is product-specific, centered around core competencies and company-centered. “An experience environment can be thought of as a robust, networked combination of company capabilities (including technical and social capabilities) and consumer interaction channels (including devices and employees), flexible enough to accommodate a wide range of individual context-and-time-specific needs and preferences” (Prahalad and Ramaswamy, 2003, p. 15).

Just as “soft skills” are the buzz word in current management studies, “soft knowledge” is a buzz word in marketing studies. “Soft knowledge” is solutions-based innovation that focuses on accumulated company expertise to create customer value.

Managerial Implications

Core competencies are no longer the goal, instead are now the means to create experience innovation because a technological capacity is only relevant when it fits the desire the consumer’s desire to improve an experience. Convergence of consumer and designer roles, as well as business and technology roles, are key to the experience innovation economy.

The top question that people ask me when people find out about my online marketing and web analytics blog, is how I came up with the name idaconcpts. I really like words that are similarly written and understood in several languages, and ideas and concepts are two of them. I played around with different variations of these words, until I realized that what my blog was truly about was putting ideas and concepts into e-commerce. Therefore, putting these ideas and concepts would be put to work into commerce, or would put the “e” in e-commerce. Hence, idaconcpts.

One of the best things of writing at idaconcpts.com is that I have a passion for analyzing photo sharing websites and my readers seem to share that passion with me.

Over 34% of the readership at idaconcpts follows the posts about the BIG 5 of photo sharing: Flickr, Photobucket, Snapfish, Shutterfly, and Slide. Please note that I am limiting myself to websites (as opposed to desktop apps such as Picasa). At the same time there will be debate about:

And my answer is that they are all great questions that I will tackle on future posts to come!

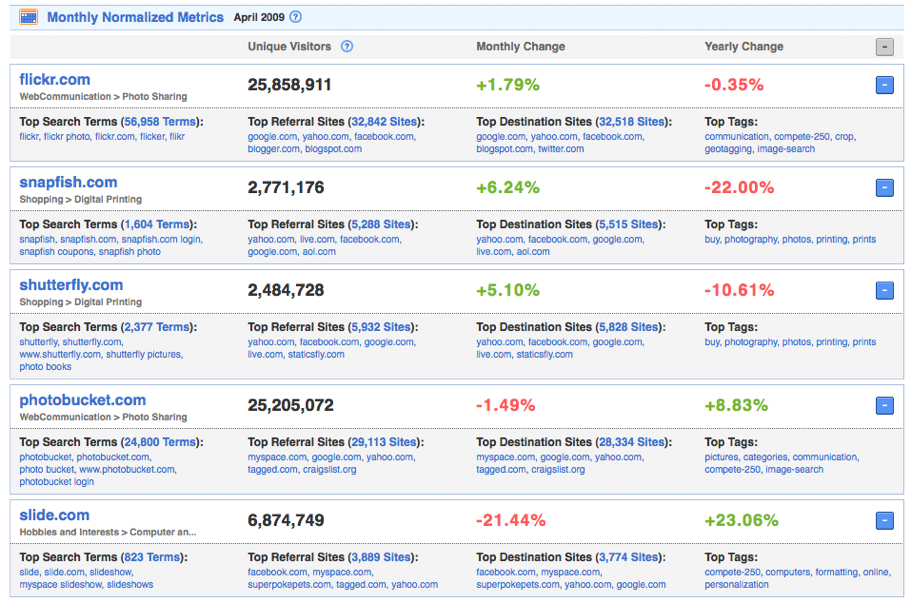

In the meantime, let’s continue the analysis of the BIG 5, which started back in November 2008 with the post Flickr versus Snapish versus Photobucket versus Slide versus Shutterfly and continued with the follow-up post Revisiting Flickr versus Snapish versus Photobucket versus Slide versus Shutterfly. In this posts we analyzed the traffic to these photo sharing websites through Google Ad Planner and Google Trends. Today we will take a look through another great web analytics called Compete.

Compete is an awesome cloud computing web analytics tool that allows you access website activity info from any website. The first killer feature of Compete is that it allows you to compare 5 websites side by side. Even though Google Trends and Google Ad Planner do offer this service, Google Trends‘ information is quite limited, and Google Ad Planner’s information is limited to a handful of websites.

Here a couple snapshots of Flickr, Photobucket, Snapfish, Shutterfly, and Slide using Compete:

The second killer feature of Compete is that it allows you to take a look into the subdomains (finally!) of entered websites. Google Trends does not (as of 05/29/2009) allow that feature, it only allows you to take a look at the web analytics of the home page.

Remember point 2 above? With this tool I can finally tap into finding out how much traffic from walmart.com goes into photos.walmart.com:

Finally, Compete allows me to post these simple little graphs, which previously I had to take a snapshot using Skitch and upload to my blog. I still love Skitch, but this saves time!

What about an updated analysis of Flickr, Photobucket, Snapfish, Shutterfly, and Slide using Compete?

Dear reader, you already have a start with the post Flickr versus Snapish versus Photobucket versus Slide versus Shutterfly and its follow-up post Revisiting Flickr versus Snapish versus Photobucket versus Slide versus Shutterfly. Now with Compete, you can slice and dice the data in no time!

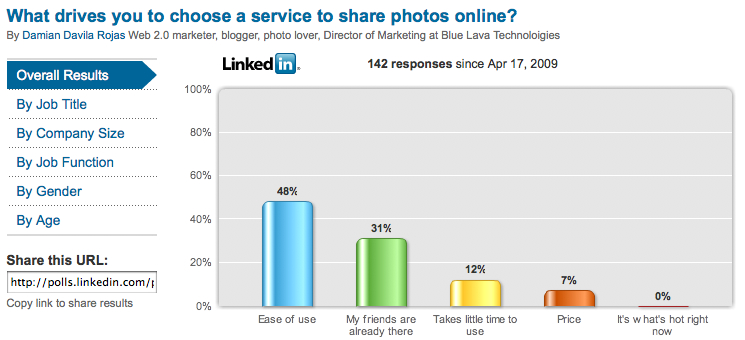

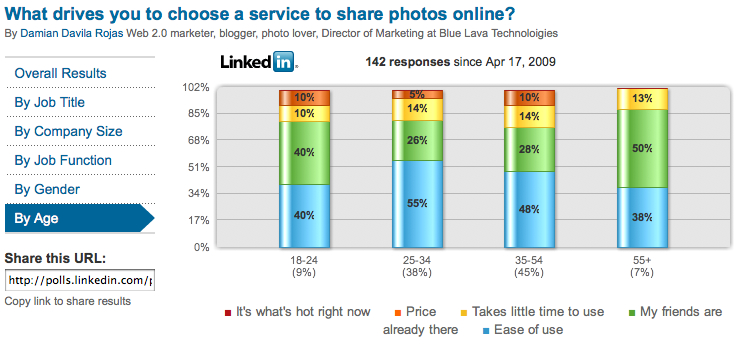

Since February 2009, I’ve been talking about permission e-mail marketing here at idaconcpts.com because it turns regular e-mails into personal, relevant and anticipated messages. An important part of the work of online marketers is polling because it provides greater insights to our questions and allows us to have better, more educated decision-making.

I have used Surveymonkey in the past and it works great but I have found that LinkedIn Polls allows polling to become more personal, relevant, and anticipated.

LinkeIn Polls is one of the applications that LinkedIn launched in October 2008 and as all of these applications they are free but require you to have a registered account with LinkedIn.

LinkeIn Polls is one of the applications that LinkedIn launched in October 2008 and as all of these applications they are free but require you to have a registered account with LinkedIn.

To access LinkedIn Polls you need to first add the application to your LinkedIn profile:

Creating a LinkedIn Poll is very simple and intuitive:

You can submit your poll to either your 1st degree connections or a target audience of professionals in the U.S (this option is free for premium subscribers). I would recommend to stick with the first option (targetting your first degree connections) because this makes your poll personal (“Hey Mike can you take a loot at this?”), relevant (“Susan, your input is important to me because I know your expertise in marketing while we worked together), and anticipated (Linkedin is a site for networking!).

An important caveat is that LinkedIn Polls is only as good as your networking power is already at LinkedIn. However, don’t believe that I’m just talking about having several contacts, I’m also referring to the number of groups and associations that you belong to in LinkedIn. If you’re active in several forums, you can get a lot of responses, and more importantly long threads of valuable qualitative data.

If you do have lots of contacts, LinedIn Polls has made it easy to segment by location and/or industry:

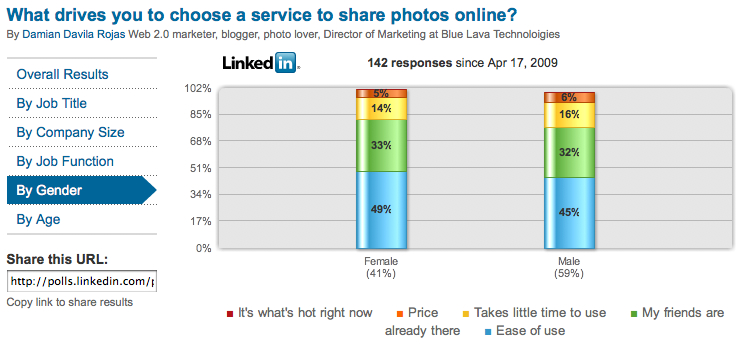

One of the most attractive feature of LinkedIn Polls is that it makes segmentation of your poll results a snap. It provides attractive bar graphs by job title, company size, job function, gender, and age.

One could easily argue that LinkedIn Polls needs options for cross-tabulation ,like Surveymonkey does, and further options for segmentations, but I strongly believe that this application is a great way to gather data fast and to create actionable bar graphs that you can e-mail to your colleagues. More importantly it follows the fundamentals of permission e-mail marketing by making polls more personal, relevant and anticipated.

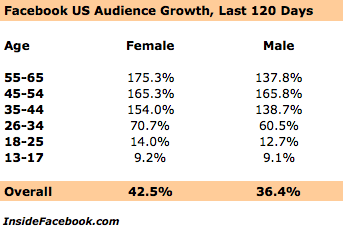

Take a look at the following numbers from InsideFacebook.com (February 2009):

This shows that the fastest growing demographic on Facebook for the last 120 days is women over 55. However, notice that during the last 120 days, there has been triple digit growth on all females group over 34 years old. As of 02/01/2009, the over 34 age group (both male and female) of Facebook stands at 22% of all Facebook population.

Smart marketers should take notice of this. Forget Big Brother. Enter the Digital Mom. There are several buzz words trying to catch the spirit of online mothers but the one that makes a lot of sense is digital mom used by Razorfish in its report, named “Digital Mom”:

Smart marketers should take notice of this. Forget Big Brother. Enter the Digital Mom. There are several buzz words trying to catch the spirit of online mothers but the one that makes a lot of sense is digital mom used by Razorfish in its report, named “Digital Mom”:

She is way beyond programming the VCR, checking answering machine messages, and emailing. Now, she’s likely to be managing the household DVR library or downloading videos/podcasts to teach and entertain; relaxing with casual or multiplayer games; using her mobile phone to text her family or browse the Web; and meeting and connecting with a wider

range of “friends” than ever before through online social networks. And digital moms are not a niche; they have, in fact, become the mainstream, representing an estimated 84% of

moms online in the U.S. today.

However, online marketers need to be pretty careful (and have a lot of common sense!) when communicating with digital moms. One of the most common complaints of digital moms is that online marketers believe that they are all alike.

The Razorfish report, Digital Mom, provides five useful core segments of socially connected moms and their implications for online marketers and social media specialists. Please notice that these 5 core segments are not to be taken as final definitions but rather as guidelines on how to develop a better understanding of digital moms.

1. The Self Expressor:

The Self Expressor is a mom who enjoys organizing and beautifying her personal profile page to reflect her ownunique style and to offer online friends an inviting place to visit. Her personal profile is often adorned with plentiful photos, her individually selected audio playlist, a custom skin reflecting her preferred design palette, and several social and expressive widgets to entertain her visiting online friends. Polls are one of her favorite ways to engage others on topics of interest and gather the opinions of many fairly quickly. She is also generous in responding to polls,and prefers the structured, efficient interaction these areas provide to completely free form conversation and blogging.

Implications for marketers: To connect with the Self Expressor, marketers should focus on providing tools and functionality that help her design, organize, and present her online social world. As she incorporates the use of these tools on her personal homepage, brands also benefit from the integration on her personal social network real estate and the viral benefit of having her spread brand messages to her online friends. Marketers may also tap her creativity and get her directly involved in a campaign—particularly if they appeal to her more visually artistic design-related nature.

2. The Utility Mom:

The Utility Mom is inclined to join online groups—particularly her local school groups or other groups providing practical information, yet she is not a frequent contributor to the conversation. She enjoys the widgets on her profile page, especially games and quizzes she can play on a regular basis whenever convenient. As another informative and fun online diversion, she will answer other moms’ poll questions, but she will not venture to create and post any poll questions of her own. She is also reluctant to upload and share photos and has the lowest numberof online photos of any of the mom segments.

Implications for marketers: To connect with the Utility Mom, marketers should associate their brands with social network features she seeks out, especially game or quiz related widgets or poll activities. While the Utility Mom has relatively few online friends, she also values product related information from other moms like her. In fact, she values the purchase related information provided by moms like her much more than that provided by her online friends. Marketers should also tap mom influencers within the social network who share other commonalities to her Utility Mom profile (similar age kids, and personal interests), but who are more comfortable creating andsharing brand messages that will resonate with Utility Mom.

3. The Groupster:

She is a very active member of the online mom community. She joins more groups than any other segment, and she ismost likely to start a new group. She generously contributes to online forums, blogs often, and asks and answers questions. She is not inclined to share photos or respond to poll questions.

Implications for marketers: Marketers can best reach the Groupster by associating with features she is already engaging with on social networks—particularly group, blogging, and message center related areas. She is more receptive recipient to brand messages and product information when in her social network, especially if these communications are coming from other moms like herself. The Groupster can also be an articulate brand advocate, and she is very capable of sharing her direct, authentic product experiences with other moms in her friend network and her shared interest groups

4. The InfoSeeker:

Overall, she is not a very engaged participant in the social network. She enjoys reading blogs and viewing others’ photos, especially those related to being a new mom. This digitally savvy younger mom is also quite comfortable uploading photos and sharing images of her new baby online. Most of her interaction with the community is centeredaround asking and answering purposeful questions. Rarely does she write blogs or post comments in groups, chat with others, or even take the time to answer polls.

Implications for marketers: Marketers looking to connect with the Infoseeker should align with the online features she is most engaging with like Q&A related content, product reviews, and even photo sharing areas. Brands that can tie in to the information she is seeking particularly on parenting issues and purchases associated with this lifestage – and do so through the highly credible voice of other moms (e.g. mom product review from another new mom like her), will be optimally received.

5. The Hyperconnector:

She is an active social network member, connecting frequently with others through both the blogs she writes and the private messages she sends. More free flowing conversational areas are her favorite—responding to open ended journal questions, commenting on others’ posts rather than responding to multiple choice polls or specific member questions. The more visual aspects of expressing herself online are not as important to her; she under indexes dramatically on sharing photos and customizing her profile page.

Implications for marketers: Marketers looking to connect with the Hyperconnector should target conversational areas of social networks where she spends much of her time. As a social network member who is comfortable both expressing herself verbally and connecting with others in social media, she is an excellent candidate to enlist directly in social influence marketing efforts. Involve her directly in your campaign to experience your product, and encourage her to generously share her articulate view

Welcome back!

Back in January 2009, I ran a post about Facebook Ads because I believe this is a great online marketing tool. This post was titled “How to target your audience using Facebook Advertising” and it touched on how to get started with an online ad.

At the end of February 2009, Facebook launched Pages as a way to allow businesses and brands to strengthen their online image on Facebook and increase the potential interaction with Facebook users.

A Facebook Page looks very much like a regular Facebook Profile and there are several organizations and business that have one.

For example, here’s the AT&T Facebook Page:

…and here’s the Facebook Page from my MBA school, the Shidler College of Business:

The difference between a regular Facebook profile and a Facebook Page is that instead of becoming a friend of a brand/organization/company, you become a fan. A well-thought feature is that brand/organization/company CANNOT add friends. This is a great practice of permission marketing because it forces users to really think whether they want to become a “fan” or not of a brand/organization/company. Therefore, the “fan” gives permission to the brand/organization/company to contact him or her, making communications personal, relevant and anticipated (the 3 pillars of permission marketing).

This is all fine, but why is the title of this post called “How to target your audience using Facebook Pages”? The answer is: Facebook Pages gives you key insights into the gender and age range of your fans. Yes, there are other nice features like number of pageviews, comments, video views and more, but the key insight is gender and age. Below is a screenshot of Facebook Pages Insight:

Having the age range and gender of your bulk of fans will allow you to tweak your Facebook Advertising campaign.

Thank you for your time and best of luck in your permission marketing campaigns!

Thank you for your time and best of luck in your permission marketing campaigns!

Apparently, the Japanese seem to think so. Via the eMarketer Daily, I found that according to Marsh Research, 84.4% of adult Internet users in Japan have felt at least once that the Internet is “scary.” Here is the breakdown:  Now, why do they consider the Internet scary?

Now, why do they consider the Internet scary?

Notice that at the top of the list appears “when lots of pop-up windows opened”. Have you been a victim of a “rickroll”? Definitely annoying. Extreme use of pop-up ads is what Seth Godin refers to as interruption marketing. You’re interrupting the natural flow of the user experience to say “hey, buy this!”. Remember that ads or communications can only be effective if they are relevant, personal, and ANTICIPATED. You need to employ permission marketing (another Godin term). I believe that the only way to a marketer can make a pop-up ad relevant, personal and anticipated is through the use of a tool such as 4Q from iPerceptions. Here’s a 10-minute video explanation of 4Q by Google Analytics Evangelist, Avinash Kaushik.

Here’s an example of how 4Q looks like at the CIO website:

Using permission based marketing initiatives, we can all make the Internet a less scary place. If you want to learn about how to get started with E-mail Permission Marketing, here’s a primer. Once you have read about it, you can learn about E-mail Permission Marketing Fundamentals.

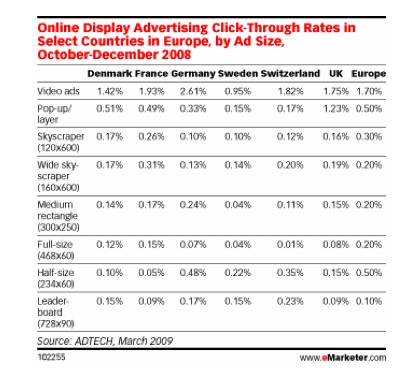

Word-on-the-street: Video ads are a savvy strategy for marketers because the number of online video viewed has been steadily growing, as reported by eMarketer, and has a high click-through rate when compared to its alternatives.

Even more, there is talk that online video ads should perform better than its alternatives during recessionary times. Erik Sass from MediaPost reports:

While not exempt from recessionary trends, it probably won’t suffer as badly as traditional media because it’s more cost-effective — but it’s still going to take a substantial hit, according to the lead speakers at OMMA Hollywood on Monday morning. Still, there are some glimmers of hope that certain recessionary trends have already bottomed out.

Online ad spending will probably fall 8%-9% in 2009, according to Dr. Paul Kedrosky, an economist and the editor of Infectious Greed, a financial blog — but that looks good compared to the rest of the media.

So, how is it possible that online ads are so great and recession proof?

One plausible explanation is the law of reciprocity by Robert Cialdini, in his book, Influence: Science and Practice (New York: Harper Collins, 1993). Basically, the law of reciprocity boils down to this: “a person can trigger a feeling of indebtedness by doing us an uninvited favor”. Consider this example from Cialdini (p. 29):

For instance, the American Disabled Veterans organization reports that its simple mail appeal for donations produces a response rate of about 18 percent. But when the mailing also includes an unsolicited gift (gummed, individualized address labels), the success rate nearly doubles to 35 percent.

Online video ads are a form of entertainment and people are willing to be entertained. An IBM study reveals that almost 60% of its study respondents said they were willing to provide to advertisers some personal information about themselves in exchange for something of value, such as access to high-quality music videos, store discounts or airline frequent-flyer points.

Therefore, the success of online video ads lies in the law of reciprocity.